Top 10 Life Insurance Companies

In this article, you will find four lists of the top 10 life insurance companies. Additionally, I give you information on how the list was developed. Hopefully, this will give you a better idea of how you can use this information to find the best life insurance policy for you. Here are the lists.

- Term Life Insurance

- Whole Life Insurance

- Senior Life Insurance

- Christian and ESG life Insurance

- (environmental, social, and governance)

Here is how the lists were developed

A list of the top 10 life insurance companies is only as good as the method used to assemble the list. Generally, sustainability and usability will determine if a life insurance policy is suitable for you. So, to fit more people’s needs, I provide you with four, top 10 life insurance companies list. Accordingly, to compile each list, I start with three factors to determine the best insurer. The first factor is the financial health of the life insurance company. Second, the specialization of the insurer is taken into consideration. Third, is the insurance readily available to the public? The additional factor of the length of time the protection is needed is added for term life insurance. Correspondingly, here is how the first factor of life insurance company financial health is utilized.

Who is keeping track of the insurer’s financial health?

Usually, people keep life insurance for many years. So, a life insurance company must have the financial stability to stay in business for a long time. Consequently, the most efficient and accurate way to determine the financial strength of a life insurance company is by using a rating service. There are five primary rating organizations. The five rating services are AM Best Rating Service, Fitch Ratings, Moody’s Investors Service, Standard & Poor’s (S&P) Financial Services, and Weiss Ratings. Some smaller life insurance companies use Kroll Bond Rating Agency. And, many of those smaller companies are fraternal organizations that offer life protection. Understanding how fraternal organizations are evaluated is not only to assess faith-based life insurance companies. You will see that some fraternal organizations are among the nation’s top-rated life insurance companies.

Not all rating companies are the same

Some other website’s list uses rating companies such as the Better Business Bureau (BBB) and J.D. Powers. However, these two ratings services are more for judging the customer service of a life insurance company. Consequently, they ignore the financial strength of the life insurance company. Customer service is important. Although, if an insurer has excellent customer service and poor investment practices, they could be out of business in twenty years. As a result, that is a problem when you are shopping for life insurance. You are shopping for a product that will not be used for many years.

Clearer understanding with Comdex

Each rating service uses its proprietary methods to determine the financial strength of a life insurance company. However, the results of each rating service are similar. I could organize a list of life insurance companies that are based on each individual rating service. But that would not be very useful. A more straightforward way to take into consideration each insurer’s company’s rating by each rating service is to use a ranking system called Comdex. “The Comdex is not a rating, but a composite of all the ratings a company has received.”[1]

Understanding the future of an insurer

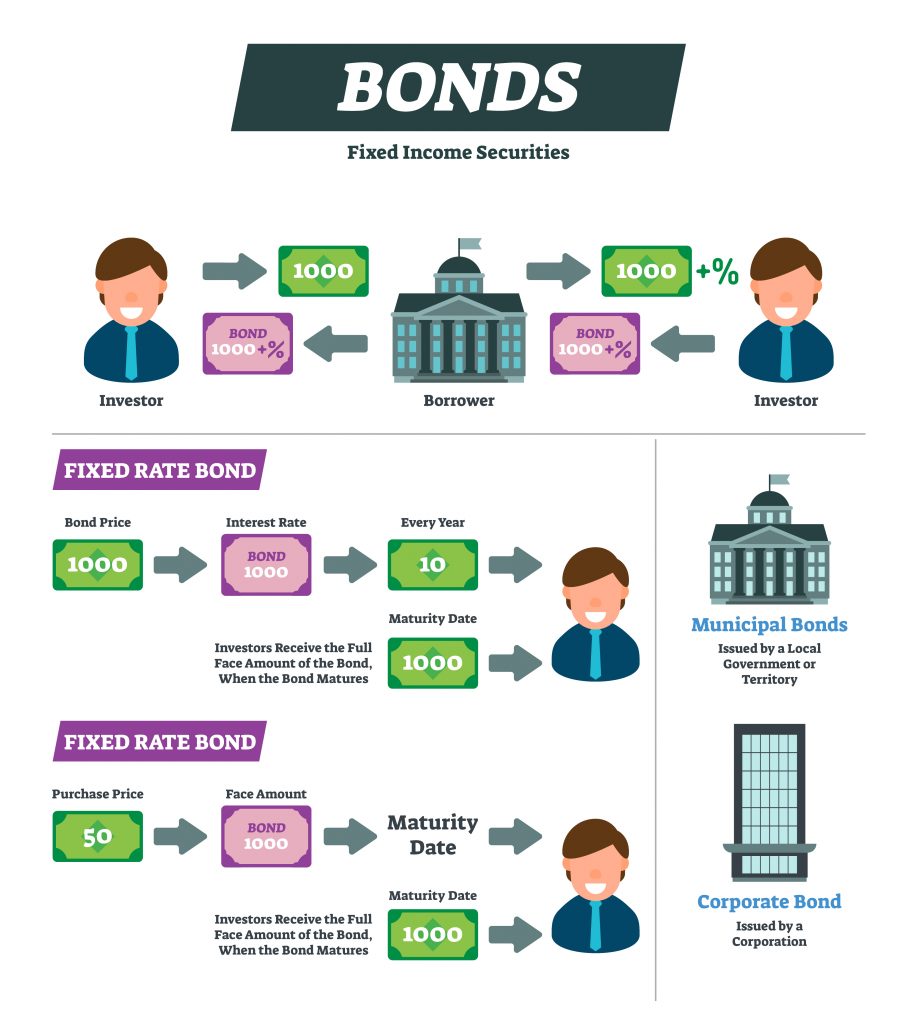

No one can predict the future. However, the future performance of an insurance company can be judged better if you know the investment quality of their investment holdings. Most insurers invest in bonds. Bonds are a loan of money. There are two guarantees that the bond issuer makes. They guarantee to pay a specific interest rate, and they guarantee to return the principal at the end of the loan period. The guarantees are only as good as the financial stability of the company issuing the bonds. What the rating companies do is analyze the bond stability as well as the life insurance company’s ability to manage the bonds in which they invest. If that sounds complicated, it is. That is why so many people depend upon the rating services of rating companies.

The importance of bonds

Ratings of bonds and life insurance companies that use bonds is far from perfect. Consequently, some companies have had favorable ratings and had future financial struggles. The analysis process used to construct most of the top 10 life insurance companies focuses on insurers that rate in the top quartile of all insurers. That process does not always work for every list. I will address the limits of using the ratings with each list. Additionally, that is why it is important to sometimes look directly at the investment quality of the holdings for the insurer.

Consequently, when considering fraternal organizations understanding the insurer’s financial data is essential. For example, the quality of the bonds, the default ratio of bonds and several other financial ratios are crucial. If there is a highly rated company available, you may be able to avoid that depth of analysis.

Don’t completely dismiss lower-rated companies.

Although, if you have health issues, obtaining life insurance from one of the higher-rated companies may not be possible. At that point, it is critical to work with an insurance agent that understands financial analysis. That information can help you determine the financial strength of the insurer that is willing to offer you a policy.

Do not let the fact that you are anxious to obtain life insurance cloud your judgment. If a life insurance company is investing its assets in bonds with a high default ratio, you need to know. This is a situation where they may appear to be a good company today. However, their money management practices are heading the company for financial ruin. There is no investment or insurance solution to cover every risk. But, the limits of a company’s guarantees will help you decide if you want a policy from a lower-rated life insurance company or not. Here is an informative graphic that explains the bond process.

Life insurance Companies use Bonds

How the top 10 life insurance company lists are arranged.

There are over five hundred insurers in the United States. To make this information more useful, I am selecting the top 10 life insurance companies in four categories: term, whole life, senior life insurance, and fraternal life insurance.

Specialization: What are your requirements?

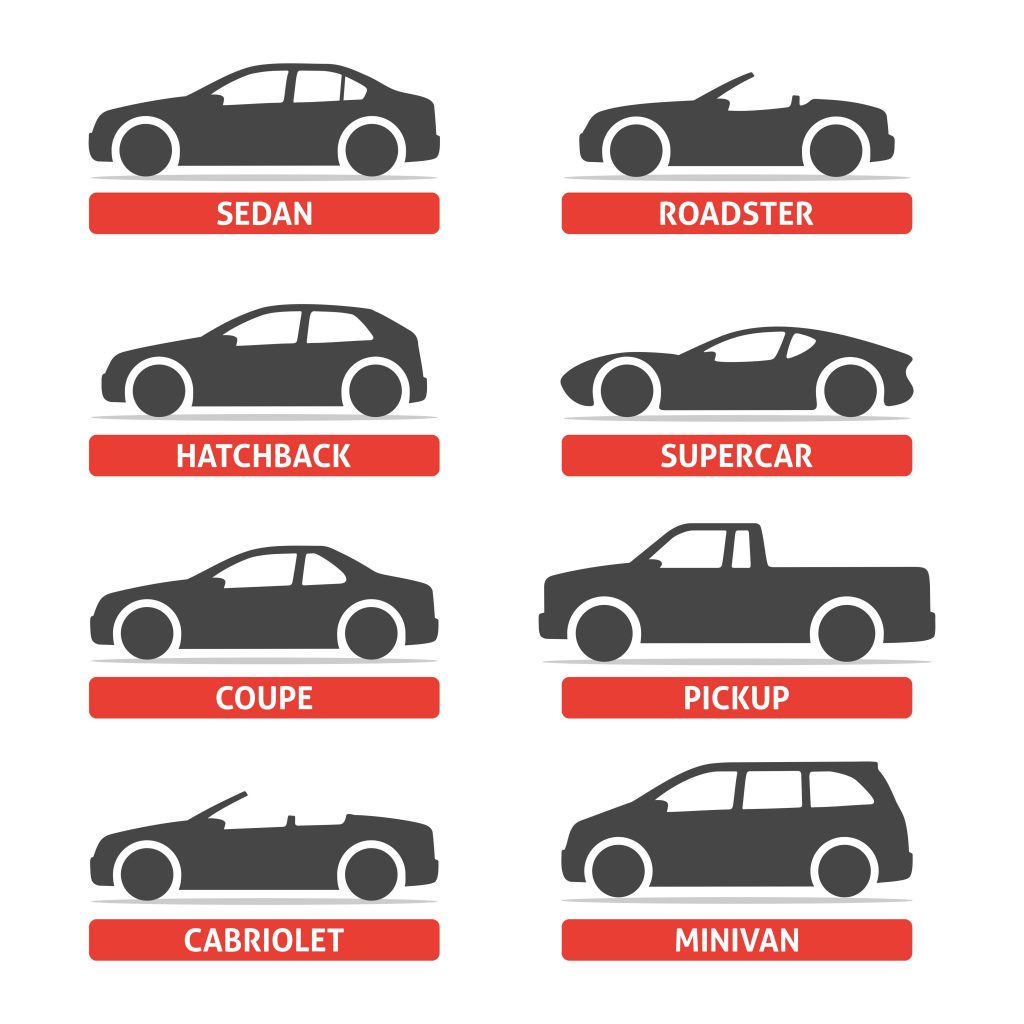

The specialization of an insurer will have a lot to do with determining the best life insurance for you. Let’s look at this analogy to explain this point. If you are asked what the best vehicle is to drive, you are stating your preference based on your needs and desires. For example, someone single or married with no children may say a Chevy Corvette or a Porsche is the best vehicle. Or, a person with a family may say a Dodge Mini-van or a Ford Explorer is the best vehicle. Someone who is environmentally conscious may say that the Chevy Bolt electric car is the best vehicle. The uses of life insurance vary as much as the use of vehicles.

Other factors to consider

The financial strength of an insurer is essential. Although that information alone will not give you the best choice. Several financial bloggers compile lists that ignores the life insurance business sector’s realities. For example, if you want an insurer that has the best 10-year term life insurance company and you determined that TIAA (Teachers Insurance and Annuity Association) is the most reliable life insurance company, you may be disappointed.

TIAA has some of the highest financial ratings with four of the five primary rating services giving them the highest rating. They have a stellar Comdex ranking of 99. Additionally, they are the biggest insurer with over 303 billion dollars in assets.[2] The reason TIAA would not be the best 10-year term life insurance company to choose is that by the end of 2019, TIAA has decided to stop selling life insurance.[3]

The best is not always the best

On a broader basis, if you want to buy the best term life insurance, the highest rated companies do not sell the most competitively priced life insurance. There are six insurers with a perfect 100 Comdex ranking. None of them offer competitively priced term life insurance. So, you finally find a life insurance company that has a competitively priced policy. If you need senior life insurance, that company is not going to be the best one for you. Surprisingly, most of those highly-rated term life insurance companies do not sell senior life insurance at all. So, how do you find the best life insurance company for your need?

To help you narrow your search here is how I grouped the top 10 life insurance companies.

- Term Life Insurance

- Whole Life Insurance

- Senior Life Insurance

- Christian and ESG life Insurance

- (environmental, social, and governance)

Top 10 Life Insurance Companies for Term Life Insurance

| Number | Life Insurance Company | Comdex Ranking |

| 1 | Thrivent Financial | 99 |

| 2 | Prudential Financial | 95 |

| 3 | Minnesota Life | 95 |

| 4 | Banner Life | 94 |

| 5 | John Hancock | 93 |

| 6 | Pacific Life | 93 |

| 7 | United of Omaha | 93 |

| 8 | Protective life | 91 |

| 9 | Lincoln National Life | 90 |

| 10 | Principal National Life | 90 |

| Alternate | Transamerica | 90 |

The order of the top 10 life insurance companies for term life insurance are listed based on the financial strength of the insurer. The order of companies based on the competitiveness of their price will change depending on your age. Transamerica is listed as an alternate company because they are more competitive at younger ages. However, for older ages, United of Omaha is more competitive.

Would you like to see which term life insurance company may offer you the most competitive price? If so, visit my Instant Quotes page to see the result of what I am writing about for you. It only takes a moment to request a quote.

The Thrivent Financial difference

Thrivent Financial is the marketing name for Thrivent Financial for Lutherans. Even though Thrivent Financial does sell life insurance protection, they technically are not a life insurance company. Thrivent Financial is a fraternal benefit society[4]. When you purchase their life insurance, you agree to be a member of the organization, and you do agree that you are a Christian.

Thrivent Financial is a very well-run company. Accordingly, their Comdex ranking is 99, which indicates that Thrivent Financial is one of the most financially stable companies that sell life insurance in the United States. However, they do not always have the most competitively priced policy for every age. That is why it is good to compare Thrivent to other companies.

Top 10 Life Insurance Companies for Whole Life Insurance

| Company | Comdex Ranking | |

| 1 | Northwestern Mutual Life Insurance | 100 |

| 2 | New York Life Insurance Company | 100 |

| 3 | Thrivent Financial | 99 |

| 4 | Guardian Life Insurance Company | 99 |

| 5 | Massachusetts Mutual Life Insurance | 98 |

| 6 | State Farm Life Insurance Company | 98 |

| 7 | Knights of Columbus | 98 |

| 8 | Mutual of Omaha Insurance Company | 93 |

| 9 | Penn Mutual Life Insurance Company | 92 |

| 10 | Ohio National Life Insurance Company | 79 |

2

Whole life insurance is simple to define. It is life insurance that will last for your entire life. When you purchase whole life insurance, you are buying a death benefit that will be level, and the cost of it will be level too. The insurance policy will have a cash value. The simplest way to describe the cash value is that there is a guaranteed cash value and a current cash value. In later years of the life insurance policy, growth in the cash value can increase the death benefit with no additional money paid out of pocket.

What makes the cash value grow?

The current cash value is dependent upon the profitability of the insurer. That is why purchasing whole life insurance from a financially secure life insurance company is essential. Additionally, the insurer should be a mutual life insurance company or a fraternal organization.

Who specializes in whole life insurance?

An insurer that specializes in whole life insurance will focus on two things. First, they provide life insurance for the entire life of their policyholders. Plus, they focus on cash accumulation. The ownership of a life insurance company will dictate its ability to maximize cash value. There are three types of life insurance companies.

- Stock life insurance companies – These companies are owned by their stockholders. Consequently, the company is designed to create maximum profits for stockholders.

- Mutual life insurance companies – These insurers are owned by life insurance policy owners. As a result, the company is designed to pass profits on to policyholders.

- Fraternal benefit organizations – These organizations are considered non-profit organizations which exist solely for the mutual benefit of their members. Accordingly, profits from the operation of the organization are passed on to the members.

Stock life insurance is not the best choice for cash value.

Stock life insurance companies do provide whole life insurance. However, those companies do not pass excess earnings on to policyholders. Stock life insurance companies’ allegiance is to their stockholders. Do not take this to mean that stock life insurance companies that offer whole life insurance are bad. You will see in a moment how they work well for those wanting senior life insurance. However, they are not the best choice for those wanting to maximize the cash value and death benefit of a whole life insurance policy.

Only mutual life insurance companies and fraternal benefit organizations are included in the top 10 life insurance companies for whole life insurance list. The reason is, those companies exist for the primary benefit of the policyholders or certificate holders. Accordingly, those companies have the best potential for cash value increases.

Fraternal benefit organization differences

Fraternal benefit organizations do have some differences from life insurance companies. The primary reason that the organizations exist is for the mutual benefit of their members. Most of the organizations will state that you should not join the organization only for the benefits. Additionally, the organizations do ask those applying to verify the acceptance of the organization’s requirements. For example, Thrivent asks those applying for life insurance to affirm one of three statements. Is the person applying for coverage a Christian, the spouse of a Christian or a child in a Christian family?

Furthermore, fraternal benefit organizations do not have the same requirements within their respective states as do life insurance companies. Their reserve levels are lower, and they are not covered by the individual state’s guarantee fund if they are insolvent. Additionally, if the organization ever becomes insolvent, it does have the right to access each member for the deficiency. In other words, if they cannot pay their bills, they have the right to share the obligations among all members. Consequently, this is another reason why financial strength is so important.

Market availability of specific whole life insurance

Some whole life insurance is only available through their life insurance company’s captive agents. For example, Northwestern Mutual Life Insurance and State Farm Life Insurance are proprietary insurers. Their life insurance policies can only be bought through their agents. Knights of Columbus is like a proprietary insurer too. It is a fraternal organization. As a result, their life insurance is only available to members of the Knights of Columbus. Members can only be men who are catholic over the age of eighteen. These companies have been included in the top 10 life insurance policies for whole life insurance despite the restrictions on their availability.

Whole life insurance companies’ Comdex Ranking

Consider an example of a twenty-year-old person that buys a whole life insurance policy. What if that person lives to be eighty, or ninety years old? Therefore, the whole life insurance policy could be in existence for up to seventy years. A financially secure insurer has a better chance of being in business for many years into the future. Although, you do not have to pick the company with the absolute highest ratings to have made the right choice. A mistake that some people make in selecting a whole life insurance company is thinking that they must purchase only the highest-rated company. The company that is on top this year may not be on top next year. Choosing a life insurance company with relatively high Comdex ranking is enough.

Top 10 Life Insurance Companies for Senior Life Insurance

| Company | AM Best | Comdex | Weiss |

| Mutual of Omaha | A+ | 93 | B- |

| Transamerica | A+ | 90 | B |

| Christian Fidelity | A- | A- | |

| Oxford Life Insurance | A- | B+ | |

| Gerber Life Insurance | A | B+ | |

| United Home Life | A- | B | |

| Americo | A | B- | |

| Fidelity Life | A- | C+ | |

| Foresters | A | C+ | |

| American Amicable | A | C |

[2]

Senior life insurance can serve several purposes. It can be used to replace the income of a spouse. It can be used to pay for final expenses such as debt elimination and funeral expenses. Or, senior life insurance can be used to leave a legacy to a family member as well as fund a donation to a charity. The overall purpose of senior life insurance is to be in force for the remainder of the life of the insured person’s life. The best type of life insurance for this purpose is whole life insurance that is designed for seniors. Most senior life insurance has a death benefit that is less than $50,000.

Knowing that you want life insurance is the easy part of the purchase process. The challenge that seniors face is choosing the right insurer. The reason is, there are many overpriced policies sold by poorly run life insurance companies. Identifying the best senior life insurance company can be very confusing. Every company has their spiel on why their plan is the best one to choose. However, financial strength is as important in selecting senior life insurance as it is with the other types of life insurance.

The importance of AM Best and Weiss

AM Best and Weiss are the primary rating companies that rates senior life insurance companies. The ratings from AM Best are similar for the top 10 life insurance companies for senior life insurance. Accordingly, the top two companies are chosen based on the availability of Comdex rankings. For the remaining eight companies, the AM Best Companies’ ratings are either A or A-. Another way to analyze the financial strength of the insurers is with Weiss Ratings.[5] Weiss Ratings is a dependable rating service that analyzes life insurance companies’ capital, asset quality, and earnings. Weiss Ratings makes understanding insurers’ financial strength “easier by breaking it down into simple terms you can understand.”[6] Furthermore, Weiss Ratings was developed in 1971 by Dr. Martin Weiss. “Weiss develops its ratings from publicly available information with minimal input from and no participation by the rated insurers.” [7]

Would you like to see which whole life insurance company may offer you a good policy for your goals? Visit my Instant Quotes page to see the result of what I am writing about for you. After you enter the initial information, you will be sent to another page. Subsequently, that page will have a button that allows you to select the duration of the policy you would like to see. At the bottom of the selection options, you will see the whole life option. In short, it only takes a moment to request a quote.

Top 10 Life Insurance Companies for Christian and ESG Life Insurance

| Company | AM Best | Weiss |

| Mutual of Omaha | A+ | B- |

| Transamerica | A+ | B |

| Christian Fidelity | A- | A- |

| Oxford Life Insurance | A- | B+ |

| Gerber Life Insurance | A | B+ |

| United Home Life | A- | B |

| Americo | A | B- |

| Fidelity Life | A- | C+ |

| Foresters | A | C+ |

| American Amicable | A | C |

How Americans spend their money is very important to them. More and more are using their moral and religious beliefs to guide how they spend their money. Generally, many Christians try avoiding doing business with businesses that may not agree with their biblical principles. ESG stands for environmental, social, and governance. Like-minded people want to do business with like-minded businesses. That is, they align their purchases with companies that are sensitive to the environment, social causes, or business governance practices. What type of company is best suited for the top 10 life insurance companies for Christian and ESG life insurance? It is fraternal benefit organizations whose membership aligns with biblical or ESG philosophies.

There is a crucial point to understand about portfolio management practices of fraternal benefit organizations. Importantly, every fraternal benefit organization must manage their assets to pay the benefits of life insurance. Consequently, financial strength is determined by how their assets are managed. The fraternal organization’s money management practices may or may not follow the beliefs or philosophies of its membership. That may sound hypocritical. However, a company has a legal fiduciary duty to manage their assets for the financial goals of their organizations.

Fiduciary responsibilities take precedence

The goal is financial stability to be able to pay a benefit. Fiduciary laws from the federal governments and state governments describe the financial duty that customers are due regardless of the beliefs and ESG philosophies. Religious beliefs and ESG philosophies are not considered by governments when enforcing fiduciary responsibilities. This is a requirement of fraternal organizations as well. Although most state boards of insurance are not as rigorous about the management of fraternal benefit organizations as they are about life insurance companies.

Money management and the active support of membership’s moral and religious beliefs are two different things. As a result, buying a life insurance policy from a fraternal benefit organization is more about being a member of an organization that follows certain moral or religious beliefs.

What is most important when choosing a life insurance company?

Usually, people buy life insurance because they want to protect or provide for family members. Additionally, people purchase life insurance if they’re going to leave a legacy to their family or a charity. So, this is the most critical question to ask yourself when choosing a life insurance policy. Does the life insurance company fulfill my goals? The second most crucial factor to consider is the specialization of the life insurance company. Lastly, what is the financial strength of the life insurance company?

To learn more about any of the life insurance policies mentioned, visit my Instant Quotes page. In short, it only takes a moment to request a quote

References

[1] EbixExchange. “The Comdex Solution.” EbixExchange Life Insurance Sales Software. Accessed August 12, 2019. https://www.ebixlife.com/vitalsigns/comdexconfus.aspx

[2] EbixExchange. VitalSigns Company List. Atlanta, GA: Ebix, Inc., 2019.

[3] Insurance Forums. “TIAA to Stop Selling Life Insurance by End of 2019.” Insurance Forums. Last modified July 2, 2019. https://insurance-forums.com/life-insurance/tiaa-to-stop-selling-life-insurance-by-end-of-2019/

[4] Thrivent Financial. “Thrivent, Built on Christian Membership.” Thrivent Financial for Lutherans. Accessed August 12, 2019. https://www.thrivent.com/about-us/what-makes-us-different/

[5] Weiss Ratings. “Our Mission.” Weiss Ratings. Accessed August 16, 2019. https://weissratings.com/our-mission

[6] Hunt, Janet. “Choose Your Insurance Company Wisely.” The Balance. Last modified May 23, 2013. https://www.thebalance.com/weiss-ratings-comprehensive-ratings-and-analysis-1969750

[7] Mangan, Joseph F. “When Comparing Apples-To-Apples Whom Should You Trust.” Insurance Journal, May 17, 2004. https://www.insurancejournal.com/magazines/mag-coverstory/2004/05/17/42616.htm