Life Insurance with Atrial Fibrillation

If you have atrial fibrillation or AFib, you can still get life insurance. Here is how four people got life insurance with atrial fibrillation. In addition to having atrial fibrillation, the people in these stories had two other things in common. First, all have a family that depends upon them, and they wanted life insurance. Second, they all thought they could not qualify for life insurance. Likewise, if you have AFib you may find that you have a similar circumstance to one of these stories. There is hope for you to get life insurance with atrial fibrillation too. But let’s get on common ground by understanding what AFib is.

How common is AFib?

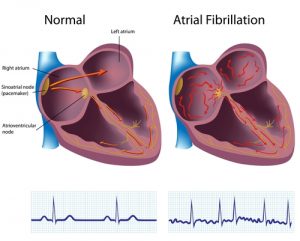

Atrial fibrillation is one of the most common forms of heart diseases. “Atrial fibrillation (also called AFib or AF) is a quivering or irregular heartbeat (arrhythmia) that can lead to blood clots, stroke, heart failure, and other heart-related complications. At least 2.7 million Americans are living with AFib.”1 In a sense, the heart develops a short circuit. The rhythm of the heart, can jump, skip, and speed up wildly.

As a result of helping people with life insurance for over thirty years, I have a lot of stories that you may relate to. The names and some of the details have been changed significantly. Privacy of information is paramount. Given that you will have enough information to see how life insurance with atrial fibrillation is possible.

Life insurance to save a farm

Luther is a seventy-year-old cotton farmer. He was born into a Texas farming family in 1947. In addition, Luther’s farm has been in his family for over one-hundred years. Furthermore, Luther has five children. Three of his children still work with him. With the help of his family, they have developed the land so that it grows cotton, raises cattle, and even has a few gas and oil wells.

Options to pay off a loan

Being that the farm needed to stay productive and competitive, Luther took out a sizeable loan for new equipment and used the farm as collateral. There have been good years and some bad for his farm. Luther was worried that if he died, there would not be enough money to pay off the equipment loan. All things considered, if Luther died, one of three things would have to happen to pay off the loan. In the first place, the equipment could be repossessed by the bank. But the farm would not have the equipment to continue operation. In the second place, the farm could sell part of its land. However, that would take away from the profits of the farm. In third place, Luther’s house could be sold. But where would his wife live?

Given these points, Luther wanted to buy life insurance. However, he thought that he could not qualify. He was turned down when he applied through the company with which he has his homeowners’ insurance. On a positive note, that is about the time that I met Luther.

Luther’s atrial fibrillation

Luther explained that he had high blood pressure and had a problem with a skipping heart for the past eight years. Luther’s doctor had diagnosed him with paroxysmal atrial fibrillation that had developed into persistent atrial fibrillation. Paroxysmal atrial fibrillation is “when your heartbeat returns to normal within 7 days.”2 With persistent atrial fibrillation, “your heart rhythm doesn’t go back to normal on its own.”3 Luther’s doctor prescribed digoxin to slow his heart and warfarin to thin his blood. He has seen a cardiologist who had him go through an echocardiogram. The test showed a mild thickening in Luther’s left ventricle and a moderate dilation of both the upper chambers of his heart. Luther explained that he still is very active. He still gets up every morning to work on the farm, and he sees his doctor regularly for a blood test.

Shopping anonymously for life insurance with atrial fibrillation

I explained to Luther that I worked with several life insurance companies, and I may be able to find one that would be able to help. I described how I could present Luther’s medical situation to the insurers without disclosing Luther’s name or personal information. That way if some of the companies declined to consider offering life insurance, it would not be in Luther’s medical files. Luther agreed, and it is a good thing that he did. One large life insurance company came back to me with an offer. They stated that if Luther would take another medical exam and the results of that exam had not changed from his last doctor exam, they would offer him a life insurance policy with a small table rating.

Health ratings are one of the ways that life insurance companies set their life insurance rates. All insurers have a health rating that is referred to as standard. There usually are as many as eight table ratings below the standard classification.

Luther took the exam that the life insurance company required. As a result, the exam showed that his health had not changed from his last doctor visit. So, he was approved for a life insurance policy with a table a rating. I called Luther with the good news, and he was delighted. You would have thought Luther won the lottery.

Key takeaway information

Knowing what medical information to gather and knowing which life insurance companies to go to, made a big difference in getting Luther approved for a life insurance policy. In like manner, if you would like to see if I can help you get life insurance click here. Enter your information. You will get an instant quote. To clarify your quote request, I will contact you.

Life insurance with atrial fibrillation for a teacher

Sally is a 58-year-old elementary school teacher. She says that she loves teaching. However, in four years, Sally will have been teaching for 40 years. She would like to retire. There is another financial complication. Sally and her husband have two adult children. One of their children is having health problems and lives with them. At this point, many middle-aged parents’ children are living on their own. In reality, Sally and her husband find themselves caring for an adult child. Not to mention their house has fifteen more years left to pay on the mortgage. Caring for their adult child and having a mortgage at this point of their lives worries Sally and her husband. If one of them died the other will be left owing a lot of money

Sally has $200,000 of term life insurance through her work. However, that will stop in four years, and if something happened to Sally, her husband Jim would be left with the entire mortgage. Sally tried getting life insurance, but she was declined because of her history of atrial fibrillation.

How Sally’s atrial fibrillation began

About five years ago, Sally began to have dizzy spells. She said her heart felt like it was jumping in her chest. For that reason, she saw a cardiologist. As a result, her doctor prescribed medication. It did not work.

The dizzy spells and heart palpitations began happening about once or twice a week. This time, Sally’s cardiologist recommended for Sally to have a procedure called a pulmonary vein ablation. It has been four years since the procedure. In time, Sally has been able to stop taking medications. Plus, she has had no further symptoms.

Finding life insurance with atrial fibrillation after being turned down

After being turned down by one life insurance company, one of Sally’s friends introduced her to me. She found my website and set up a telephone appointment. Sally was surprised to learn that there are life insurance companies that will consider people who have a history of atrial fibrillations. I took all of Sally’s information online and found her a fifteen-year term life insurance policy with a very well rated life insurance company. As I have noted in the previous story, insurers price their policies by health ratings. Most life insurance companies have at least fourteen health ratings. A standard rating is usually the third or fourth rating. The policy Sally was offered was a standard risk. Most importantly, it gave Sally an affordable life insurance. That meant the life insurance would allow her family to keep their house and their family together in the event the worst happened. However, Sally and her husband are looking forward to her retirement in four more years and much more after that.

Key takeaway information

The was one key to finding life insurance for Sally. In short, it was finding an insurer that would look at her the success of her recovery. Even though she had a history of AFib. In like manner, if you would like to see if I can help you get life insurance click here. Enter your information. You will get an instant quote. To clarify your quote request, I will contact you.

Stress can cause atrial fibrillations

Walter is a 40-year-old CPA with three children. And Ann, his wife is a stay-at-home mom. Walt has a lot of irons in the fire. In fact, he runs a small accounting practice. Walt has a son and two daughters. In addition, Walt coaches his son’s baseball team. Plus, both of his daughters are in dance. He makes almost every one of his children’s events. Coupled with family commitments, Walt is also very active in two chambers of commerce groups. To put it another way, Walt has a lot going on.

About five years ago, Walt started to feel like he just did not have the physical stamina that he used to. Plus, it seemed like over the past several years around the April and October tax deadline he felt worse. At this time, Walt would start to get out of breath. He felt the collars to his shirts felt like it was a size too small. At first, he just thought it was the long days of tax season, but Ann encouraged him to see his doctor. Walt’s doctor had him do an echocardiogram and EKG stress test. As a result, the test showed that Walt’s heart was normal.

Holiday Heart Syndrome

Walt explained to his doctor that he only seemed to have problems around stressful times. After that, Walt’s doctor told him that he might have what some people call Holiday Heart Syndrome. As a result, the heart will have atrial fibrillations when he is going through stressful situations. His doctor also prescribed metoprolol which is a medication to slow the heart. He only needed to take medicine when he had symptoms. Being that, it was September when Walt saw his doctor. So, the doctor suggested that for a few days during the tax season, Walt should wear a Holter monitor. This is just a small device that measures the heart continually for a few days.

Stress triggers

Sure enough, before October 15th when Walt was putting in fourteen-hour days, he started to have heart palpitations. Consequently, they showed up on the Holter monitor test. As a result, Walt’s doctor told him that since they only occurred at certain stressful times to try to control the stress. To that end, his doctor suggested that he include daily exercise and control his diet. Due to long days, Walt tended to live on pizza and burgers during tax season. So, Walt committed to regular exercise and a better diet year-round. Plus, he could continue to take the metoprolol when he felt it was necessary.

Walt and I knew each other through common business connections. So, he asked him about life insurance. Walt told me that he had applied through his professional association but had been declined. I have had a lot of experience dealing with how life insurance companies and their view adverse health conditions. Consequently, I knew exactly how to help Walt. I did the same process that I used with Luther in the first story. Walt completes a general form called a Time Saver application. This is a short form that gathers medical information about the person applying for life insurance. I then submitted the Time Saver to about thirty different life insurance companies asking their opinion on Walt’s insurability.

How the Time Saver works

I explained that the good part of the Time Saver process was that only Walt’s medical information was shared with the life insurance companies. More important, Walt’s name and other identifying details were not disclosed. Under those circumstances, if some of the thirty life insurance companies declined to offer coverage, it would not be on Walt’s medical record. That is if he were declined, it would not affect him if he applied for future insurance.

The results of the Time Saver were good. Consequently, several life insurance companies came back with offers. As a result, the best offer was a twenty-year term life insurance at a standard rating. I also explained to Walt that if he got to the point that he could control the palpitations without medication, he should consider re-applying. In due time, he may be able to get a health rating better than standard.

Key takeaway information

In this case, the key to Walt getting life insurance was knowing that having one decline of life insurance at his age was not good. In like manner, another decline could doom his chances of getting life insurance. The more life insurance companies that declined coverage, the harder if not impossible, it would be to obtain future coverage. Given these points, being able to present his condition anonymously to many life insurance companies made a significant difference in obtaining coverage. In like manner, if you would like to see if I can help you get life insurance click here. Enter your information. You will get an instant quote. To clarify your quote request, I will contact you.

Life Insurance with atrial fibrillation for a doctor

Camille is a 35-year old physician who is married with one child. After looking at their overall debt and the cost of raising a child, Camille and her husband decided that they needed life insurance. Camille has group life insurance, that is one time her salary through her work. However, she felt that was not enough.

Here is a little about her health history. Three years ago, at the age of 32, Camille began to feel like her heart was skipping. At night when she would lie in bed her heart would pound, and she had a terrible time controlling how hot she felt. As a doctor, Camille had a good idea that she had atrial fibrillations. However, she just did not know what was causing them. In general, she was young, exercised, and ate a well-balanced diet. To that end, Camille saw her personal doctor. They both agreed that she see an endocrinologist.

The endocrinologist did several blood tests. To that end, Camille was diagnosed with hyperthyroidism. In time, after her thyroid disease was treated, Camille’s palpitations disappeared. Above all, she has been fine since.

Knowing were to turn

Camille obviously knew a lot about medicine. However, she thought that her medical condition would undoubtedly prevent her from getting life insurance. On the positive side, she was discussing her situation with a colleague. Given that, her colleague knew me and suggested that Camille contact me.

Camille had never applied for life insurance. Although she understood the medical aspects of her condition very well. In summary, she explained her situation to me through a telephone appointment. As a result, I was able to find a well-rated life insurance company that gave Camille a twenty-year term life insurance policy with a preferred rating, the lowest price available at Camille’s age. Camille was pleased.

If you would like to learn more about well-rated life insurance companies that offer term life insurance, read my blog “Top Ten Life Insurance Companies.”

Key takeaway information

The key to finding Camille a life insurance company that would give her a preferred rating was communicating her condition, her healthy lifestyle and her proactive approach toward staying healthy. For this purpose, gathering all that information only from the form used to apply for life insurance was unlikely. In this situation, communicating those positive aspects in a well-written cover letter was an essential aspect of obtaining such a good health rating for Camille’s life insurance. In like manner, if you would like to see if I can help you get life insurance click here. Enter your information. You will get an instant quote. To clarify your quote request, I will contact you.

Post Script

Atrial Fibrillation is the most common abnormal heart rhythm in the United States, affecting approximately 2.7 to 6.1 million Americans.4

If you have been diagnosed with AFib, it may still be possible to get life insurance. To find out if you qualify for life insurance click here or on the orange quote now button. Enter your information, and I will contact you. The consultation is free, and it may save you money, time and help you find the life insurance you want.

The information provided does not disclose any personal information of current, past, or prospective clients. The names and pictures used are fictional. However, the situations are genuine. If you have circumstances like the examples, there is not a guarantee that you will be able to obtain a health rating precisely like those in the stories. Let’s talk and see what we can find for you. If you prefer, you can call me (Van Richards) at 713-320-6124

I will remind you that this information is not intended to communicate medical health recommendations. My principal goal is to help you better communicate your health condition to a life insurance underwriter in hopes of getting a favorable life insurance policy.

References

1“Atrial Fibrillation.” American Stroke Association. Accessed September 18, 2019. https://www.stroke.org/en/health-topics/atrial-fibrillation

2Beckerman, MD, FACC, James. “What Is Paroxysmal Atrial Fibrillation?” WebMD. Last modified May 2, 2018. https://www.webmd.com/heart-disease/atrial-fibrillation/paroxysmal-atrial-fibrillation-facts#1

3Mayo Clinic. “Atrial Fibrillation – Symptoms and Causes.” Last modified June 20, 2019. https://www.mayoclinic.org/diseases-conditions/atrial-fibrillation/symptoms-causes/syc-20350624

4National Center for Chronic Disease Prevention and Health Promotion. “Atrial Fibrillation Fact Sheet.” Centers for Disease Control and Prevention. Last modified November 2, 2018. https://www.cdc.gov/dhdsp/data_statistics/fact_sheets/fs_atrial_fibrillation.htm