Spouse Protection from Family Financial Feuds After You Die

Safeguarding your spouse is one of the most instinctive characteristics of married couples, a theme even depicted in Greek mythology. In the epic tale of the Trojan War, Prince Paris of Troy abducts Helen. That treachery sparked a ten-year conflict as the Greeks, led by King Menelaus of Sparta, fight to reclaim her. This act of protection and conflict over a spouse’s wellbeing mirrors the lengths we might go to ensure our loved ones are cared for, especially in estate planning matters. Of course, the movie with Brad Pitt took some poetic license to stretch the story.

But picture this: In your life story, envision Brad Pitt (also known as Achilles) playing you! And he (you) are fighting to protect your wife before you die.

This is Your Life

Your life story is probably full of stories of potential challenges and the genuine risk of sparking disputes over your spouse’s care if you die before them. Or your child(ren) could be arguing over who has the legal right to care for a surviving parent and take care of their money. They may quarrel with your surviving spouse, whom they believe is incapable of making decisions for themselves.

You have likely heard similar stories about someone you know. Maybe you or a family member has experienced something similar. It is an occurrence that will affect your family dramatically and sometimes horrifically. But you can prevent it or significantly reduce the severity.

These delicate matters highlight the importance of taking proactive steps to secure your spouse’s financial and emotional wellbeing. Doing something now protects your spouse from unnecessary distress during difficult times.

This article outlines a clear roadmap to safeguard your spouse’s interests.

- Communicating your wishes clearly through letters of instruction

- Set Up Legal Protections

- Appointing trustworthy trustees and executors

- Ensure Spousal Protection with Durable Power of Attorney and Healthcare Directives

- Perhaps distribute assets during your lifetime

- Explore the benefits of utilizing mediation and professional services

- And finally, regularly reviewing and adapting to life events

By adopting these approaches, you shield your spouse from many challenges, including making decisions about memory care and palliative care. These steps will help mitigate the emotional and financial distress following a loss.

1. Communicate Your Wishes Clearly

First and foremost, clear communication about your estate plan is crucial. It’s not enough to simply state your wishes verbally. They must be documented in writing, with the appropriate legal documents in place. This ensures that your intentions are understood and can help prevent misunderstandings and disputes among family members after your passing.

Importance of a Detailed Will

Creating a detailed will is crucial in delineating your wishes regarding asset distribution. With specific instructions, family members cannot improvise, potentially leading to conflicts and legal challenges. By specifying who receives what, from personal items to financial assets, you can minimize disputes and ensure your legacy is honored as you intended.

As a planning note, most wills do not have finite details. You can include your specific wishes, usually as precatory instructions. That means that details are your wishes or suggestions. That precatory language has a much better chance of being carried out if you let it be well-known to your heirs when you establish your will.

While some states require more details, here are the basic requirements of a will.

General Will Requirements

- signature of the creator or the will (testator) at the end of the document

- date

- witnesses

- legal capacity- the testator must be mentally competent when signing the will, not at the time of their death. –– age of state majority –– mental competence

Discussing Your Plans with Family

It’s best to talk about your estate plan openly with your family. It might feel awkward. And don’t be surprised if you get some pushback from some family members saying they don’t want to talk about death. But if not now, when? It’s a critical step in ensuring everyone understands your decisions and reasons.

Do it within your timeframe, not someone else’s. Organize a family meeting where you can explain your will and any trusts or directives you have set up. Transparency with your executors, guardians, and trustees about your wishes can prevent potential conflicts. Remember, this should be an ongoing conversation reviewed regularly to address any changes or concerns.

2. Set Up Legal Protections for Your Spouse

An essential part of clear communication is assuring that your intentions comply with federal and state estate laws. After all, all the planning in the world can only be meaningful if it is enforceable.

Establishing a Trust

From the outset, you know that estate planning is something that you will need an attorney for. Yes, you can do a simple will without an attorney. But when you get to trust, you need an attorney. As far as doing your own will, consider using an attorney for that too. Why? You don’t know what you don’t know.

What is a trust?

A trust is like a legal person or company. Its rights and powers may vary depending on the language used. In a trust, one person, the grantor, gives another person, the trustee, the right to manage property or assets for the benefit of a third person, the beneficiary.

Different types of trust

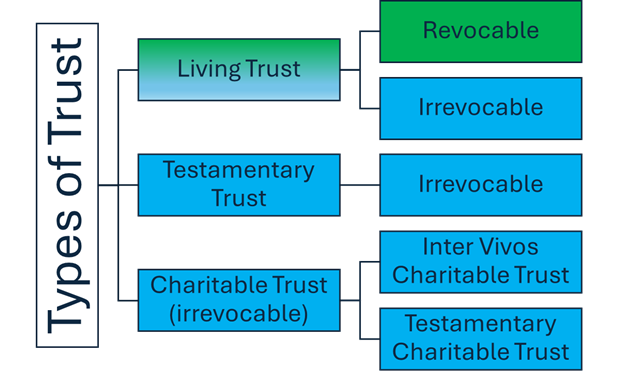

There are three primary types of trusts: living, testamentary, and charitable.

1-Living Trust (Inter Vivos Trust):

- Created during the grantor’s lifetime.

- Can be either revocable or irrevocable.

- Revocable Trust: The grantor can freely remove property from the trust.

- Irrevocable Trust: The grantor cannot remove property once it has been transferred to the trust.

2-Testamentary Trust:

- Created upon the death of the grantor.

- Always irrevocable, meaning the grantor cannot change or remove property from the trust once it is established.

3-Charitable Trust:

- Created for the benefit of a charity.

- Can be established during the grantor’s lifetime (Inter Vivos Charitable Trust) or at the grantor’s death (Testamentary Charitable Trust).

The timing of creating and the ability to change the trust are important in defining its type and terms. Living trusts offer flexibility while the person who made the trust is alive, while testamentary trusts ensure a fixed distribution of assets after the person’s death. Charitable trusts help support charitable efforts right away or as a lasting legacy.

The Importance of a Financial Advisor

Using a financial advisor can be a significant help. Their expertise and guidance can ensure the proper management of your trust. Without following a specific process, the trust’s tax status and your intent for the assets may be voided. Their professional services are essential. In conjunction with an estate planning attorney, a financial advisor is crucial for creating a comprehensive strategy that ensures your financial goals are met and your assets are protected.

A financial advisor can also help you understand complex investments, Social Security survivor benefits, and retirement plan optimization and tailor a plan that considers your family’s unique dynamics. Credentialed financial advisors such as a ChFC, CLU, or CFP are also experts in insurance, both annuities and life insurance.

Together, an attorney and financial advisor form a synergistic team that can navigate the intricate interplay between finance and law. They can provide peace of mind that your legacy and loved ones are well cared for.

3. Appointing trustworthy trustees and executors

Using a Non-Family Member as Executor

Selecting a non-family member as the executor of your will can mitigate conflicts and ensure impartiality in the administration of your estate. Professional trustees, such as bank trust departments, often offer the expertise and neutrality needed to manage complex estate situations effectively. This approach is especially beneficial in families where dynamics might lead to disputes, ensuring that your estate is settled according to your wishes without bias or undue influence.

Suppose you want to allow the professional trustee to make only some of the decisions. In that case, you can arrange for a family member to be a co-trustee.

4. Spouse Protection with Durable Power of Attorney and Healthcare Directives

A comprehensive estate plan includes essential documents, such as a durable power of attorney and healthcare directives, that protect a spouse’s interests.

1-Durable Power of Attorney:

- Purpose: Grants a spouse or another trusted individual the authority to manage financial and legal matters on behalf of the grantor.

- Protection: Ensures that the spouse can handle affairs such as paying bills, managing investments, and making financial decisions if the grantor becomes incapacitated.

2-Healthcare Directives:

- Purpose: Includes documents like a living will and a healthcare power of attorney.

– – Living Will: Specifies the grantor’s wishes regarding medical treatments and end-of-life care.

– –Healthcare Power of Attorney: Designates a spouse or another trusted individual to make medical decisions on the grantor’s behalf if they cannot do so.

- Protection: Ensures that the spouse can make critical healthcare decisions and advocate for the grantor’s medical preferences, providing peace of mind and clarity during difficult times.

Together, these documents safeguard a spouse’s ability to manage the grantor’s affairs and make essential decisions, thereby protecting their interests and ensuring the grantor’s wishes are respected.

5. Distribute Assets During Your Lifetime

Distributing assets during one’s lifetime is not just a strategic approach, it’s a way to feel empowered and in control. It allows individuals to witness the benefits their gifts provide to loved ones and offers significant tax advantages. One can utilize various exemptions to reduce future estate tax liabilities by transferring wealth while still alive.

Gifting During Lifetime

One effective method is the annual gift tax exclusion, which permits gifts up to $17,000 per recipient (for 2023) yearly without incurring any gift tax. For married couples, this amount doubles. Additionally, payments made directly to medical providers or educational institutions on behalf of a beneficiary are exempt from this tax, providing a practical way to support loved ones without diminishing one’s lifetime gift tax exemption.

Creating a Letter of Instruction

Alongside physical gifts, a letter of instruction can be invaluable. This letter is the precatory document mentioned earlier. While it is not legally binding, it clarifies the intentions behind a will, ensuring that one’s wishes are understood and followed. It outlines detailed instructions on asset distribution and can include personal sentiments and directives that might not be appropriate for more formal estate planning documents. Using precatory language ensures a smooth transition and helps mitigate potential conflicts or confusion among heirs.

6. Utilize Mediation and Professional Services for Your Spouse

If you anticipate a conflict, you should consider pre-arranging mediation. Mediation is a voluntary and confidential process that involves a neutral third party. The mediator facilitates communication and negotiation between disputing parties. This method is especially beneficial in family law, addressing issues like divorce, child custody, and financial matters efficiently and with less emotional strain. Mediators do not decide the outcome but help parties find mutually agreeable solutions, preserving family relationships and reducing legal costs.

The Role of a Mediator for Your Spouse

Mediators ensure a balanced process by allowing both parties to voice their concerns, promoting fairness. They provide general legal information, assist in negotiation, and encourage constructive communication, helping parties focus on practical solutions. Once an agreement is reached, mediators can draft a detailed settlement agreement for review by each party’s attorney, ensuring the decisions are well-documented.

A unique service that offers a way to inventory your property and share it with family members is FairSplit.com. FYI, there are two companies called FairSplit: FairSplit.com and FairSplit.ai. FairSplit.com offers home inventory services, as well as mediation and administrator services.

If you anticipate disagreements within you, setting up a system to decide your personal property and estate can save your family from the anxiety and turmoil after you die.

Independent Fiduciary Services

An independent fiduciary is someone or an entity that is unbiased and duty-bound to act in your spouse’s best interest. These professionals apply their expertise without the emotional involvement of family dynamics, ensuring efficient management of estate matters. They are knowledgeable about and equipped to execute instructions effectively, making them a reliable choice for handling sensitive family financial affairs.

7. Review and Update Regularly

Review After Major Life Events

A major life event, such as a marriage, divorce, the birth or adoption of a child, or even the unfortunate loss of a family member, can alter your intentions for asset distribution. Updating your financial and estate plan during these times ensures that your assets are distributed according to your current wishes. And if there are new family members, they are treated according to your wishes. Additionally, if there are former ones, you may want them appropriately removed.

Periodic Updates and Revisions

Besides major life changes, periodic reviews of your financial and estate plans are prudent to ensure they align with your goals. It’s a good idea to review your estate plan at least every five years or sooner if your financial situation has changed significantly or if estate laws have changed.

Conclusion

Through careful planning and proactive measures, securing your spouse’s financial wellbeing and emotional peace after your departure is a noble and achievable goal. By clearly communicating your wishes, establishing trusts, and appointing unbiased executors, you set a solid foundation to prevent familial feuds. Using proactive strategies like distributing assets during your lifetime and employing mediation services when necessary further shows a commitment to maintaining family harmony.

You might not be Achilles (or Brad Pitt). Still, these efforts show that you love and care for your spouse.

Regularly reviewing and updating your estate plans to reflect life’s inevitable changes ensures that your legacy is preserved and your spouse is protected in the manner you desire. Equipped with the right tools and knowledge, you can confidently navigate the intricacies of estate planning to mitigate potential conflicts and uphold familial bonds. Download our free guide, ’10 Essential Steps to Bulletproof Your Estate Plan,’ to start ensuring your spouse’s financial security and maintaining family harmony. Let this guide serve as your compass, steering you towards peace of mind and securing your family’s future amid life’s uncertainties.

FAQs

Preventing Your Spouse’s Future Partner from Inheriting Your Assets

Q: How can I ensure my spouse’s future spouse doesn’t inherit my assets?

A: To prevent your spouse’s future spouse from inheriting your assets, consult with an estate planning attorney to explore your options. One approach could be to allocate a portion of your estate to your children and the remainder to your spouse.

Managing Money with a Financially Irresponsible Spouse

Q: What steps can I take if my spouse is not good with money?

A: If your spouse struggles with financial management, working together as a team is essential. Develop a budget, discuss money issues regularly, establish an emergency fund, and address outstanding debts together.

Handling Finances After Your Spouse’s Death

Q: What financial actions should I take after my spouse passes away?

A: Following the death of your spouse, you should contact your attorney, locate your spouse’s will, reach out to their former employers, notify all insurance companies, update titles on joint accounts, and meet with your accountant or tax preparer.

Preventing Family Disputes Over Inheritance

Q: How can I avoid family conflicts over inheritance?

A: To minimize inheritance disputes, parents should clearly express their wishes in a will, consider setting up a trust, appoint a non-sibling as executor or trustee, and possibly give gifts during their lifetime. After a parent’s death, siblings might consider mediation, liquidating assets to split the proceeds, or deferring to an independent fiduciary to manage disputes.