Life Insurance for (your) Parents: A Comprehensive Guide

As someone with over 30 years of experience in the insurance industry and having helped hundreds of families secure their financial future, I want to share some straightforward guidance on purchasing life insurance for your parents.

Why Consider Life Insurance for Your Parents?

Life insurance can be a crucial financial tool that provides peace of mind, knowing that expenses like funeral costs, medical bills, or outstanding debts won’t become an unexpected burden during an already difficult time.

The Process: How to Purchase Life Insurance for Your Parents

1. Establish Insurable Interest

Before purchasing a policy, you’ll need to demonstrate that you would face financial hardship if your parent passed away. This could include:

- Shared financial responsibilities

- Responsibility for their final expenses

- Outstanding loans where you’re a co-signer

- Potential caregiving costs

2. Get Their Consent

This is non-negotiable – your parent must agree to the policy and be actively involved in the application process. They’ll need to sign documents and possibly complete medical questionnaires.

3. Complete the Application Process

The application will require basic information including:

- Personal details (name, address, SSN)

- Medical history

- Lifestyle information

- Financial background

4. Medical Underwriting

Depending on the policy type, your parent may need to:

- Complete a health questionnaire

- Undergo a medical examination

- Provide medical records

- Take blood and urine tests

5. Review and Accept the Offer

Once approved, carefully review:

- Coverage amount

- Premium costs

- Policy terms and conditions

- Any exclusions or limitations

6. Make the First Premium Payment

The policy only becomes active after the first premium payment.

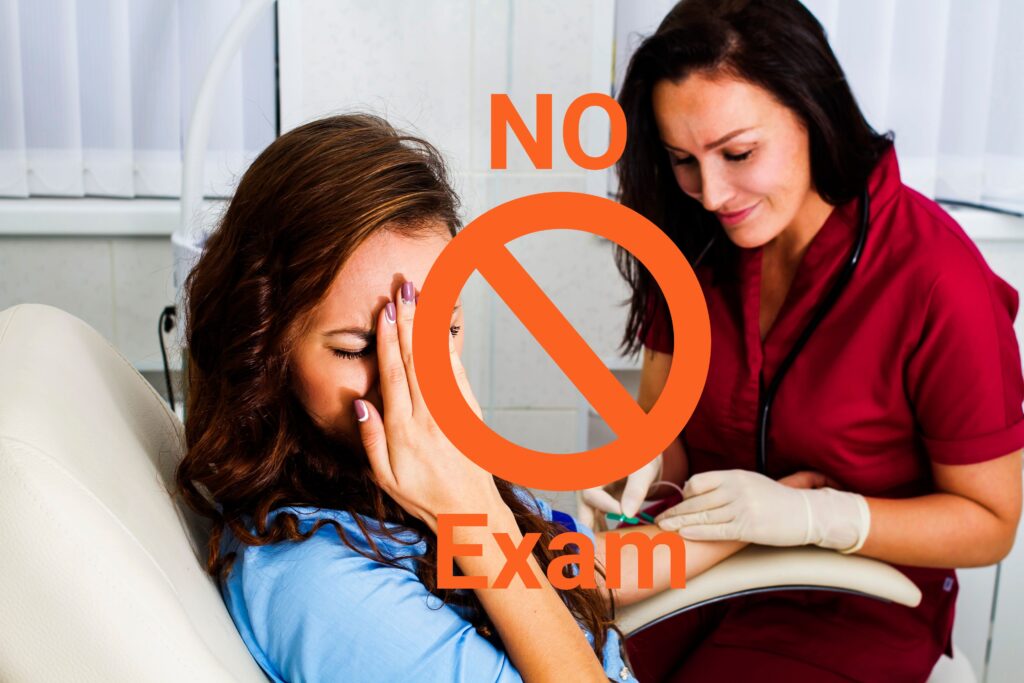

Alternative Options for Parents with Health Concerns

If your parent has health issues, consider:

Simplified Issue Policies: These require limited health questions and no medical exam, though premiums may be higher and coverage amounts lower.

Guaranteed Acceptance Policies: Available regardless of health status, these typically have waiting periods (usually 2-3 years) before full benefits apply, higher premiums, and lower coverage amounts. Legal and General America is a good example of a respected guaranteed acceptance life insurance company. To compare premiums, click the button below.

Let Me Help You Navigate This Process

Finding the right life insurance coverage for your parent doesn’t need to be complicated. With my decades of experience as a Chartered Financial Consultant (ChFC) and Retirement Income Certified Professional (RICP), I can help you find solutions tailored to your specific situation.

Feel free to reach out with any questions or concerns – I’m here to make this process as smooth and straightforward as possible. Email van@advice4lifeinsurance.com

Secure the best life insurance for you—compare personalized quotes to protect yourself and your loved ones.

Van Richards, ChFC, RICP