Life Insurance After Prostate Cancer: What You Need to Know

Introduction

A diagnosis of prostate cancer can be a life-altering event, not only for a man but also for his loved ones. When faced with your own mortality, a lot goes through your mind. One of the biggest questions is how will my family survive without my financial support. The solution to that concern may be life insurance. The natural question is, can I qualify for life insurance after prostate cancer? The good news is that it is possible to secure life insurance coverage even after a prostate cancer diagnosis. If caught early enough, prostate cancer has a history of being manageable. In this article, we will explore the key aspects of getting life insurance after prostate cancer, including eligibility criteria, the application process, and the best insurance companies for prostate cancer survivors.

Can You Get Post-Prostate Cancer Life Insurance?

The answer is yes! While a prostate cancer diagnosis may initially seem like a setback to getting life insurance, advancements in medical treatments and increased awareness have prompted many insurance companies to revise their application process. It is important to note that the availability and terms of coverage may vary among insurance companies. However, with proper documentation and a strategic approach, men can find life insurance that meets their needs.

Understanding Prostate Cancer and its Impact on Life Insurance

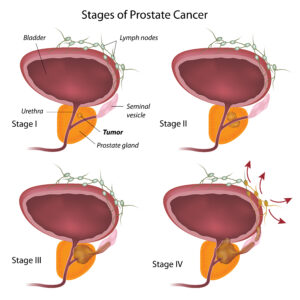

Prostate cancer is one of the most common forms of cancer in men. It develops in the prostate gland. The severity and stage of prostate cancer can vary, ranging from localized tumors to more advanced cases that have spread to surrounding tissues or distant organs. When considering life insurance applications from individuals with a history of prostate cancer, insurance companies consider several factors:

Age at Diagnosis

The age of diagnosis for prostate cancer impacts how the insurance company will offer coverage. Younger men diagnosed with prostate cancer may face more questions from insurance companies because the disease is rare in this age group. On the other hand, older individuals with low-grade prostate cancer may have a higher chance of immediate coverage after successful treatment.

PSA Levels

The prostate gland produces a protein called prostate-specific antigen (PSA). Elevated PSA levels can show the presence of prostate cancer. Insurance underwriters review an applicant’s PSA levels, taking into account the most recent test results. Insurance companies tend to consider lower PSA levels more positively.

Cancer Stage and Grade

The stage and grade of prostate cancer provide an important understanding of how severe it is and the outlook. Insurance companies are more likely to provide coverage for localized prostate cancer as it is less risky. Additionally, individuals with low Gleason scores (a measure of how aggressive the cancer is) have a higher chance of getting good policy terms.

Treatment Options

The treatment approach chosen to manage prostate cancer can influence insurance underwriting decisions. Common treatments include active surveillance, surgery, radiation therapy, and hormone therapy. Each treatment option carries its own risks and outlook, which insurance companies take into account when considering if they will offer insurance.

Overall Health

Insurance companies also consider a man’s overall health, including past and present medical conditions. Factors such as weight, cholesterol levels, and overall fitness can impact the application process. Insurance companies may require individuals with a history of prostate cancer to provide more health information.

The Underwriting Process for Life Insurance After Prostate Cancer

When applying for post-prostate cancer life insurance, it is crucial to understand the application process. Insurance companies assess various aspects to determine a man’s insurability and premium rates. The application process has several steps that are important to understand.

Medical Questionnaire

Insurance applicants must complete a medical form with questions about their prostate cancer diagnosis, treatment, and current health. It is crucial to provide accurate and complete information.

Medical Records and Documentation

Insurance companies may request medical records and pathology reports to verify the details provided in the medical form. These records help the insurance company assess the prostate cancer and determine how well the treatment worked.

PSA Test Results

Insurance companies often review a man’s PSA test results to gauge the current status of prostate cancer. Lower PSA levels and ongoing monitoring can help obtain a better insurance decision.

Additional Medical Exams

Insurance companies may require more medical exams, such as physicals, blood tests, and imaging studies. These exams provide a complete view of a man’s health and help insurance companies assess overall risk.

Underwriting Decision

Based on the information gathered from the medical form, medical records, PSA test results, and any extra exams, insurance companies look at the risk of offering coverage to an individual with a history of prostate cancer. The insurance company’s decision determines if they will offer coverage and the premium rates.

The Best Life Insurance Companies for Prostate Cancer Survivors

When it comes to getting post-prostate cancer life insurance, choosing the right insurance company is crucial. Here are some top insurance companies for prostate cancer survivors:

Prudential Life Insurance Company

Prudential’s flexibility is ideal for those who have completed treatment for prostate cancer. They offer good rates and terms for men with a history of the disease.

Protective Life Insurance Company

Protective Life Insurance is known for offering coverage to those with a history of prostate cancer. If a man’s PSA levels are consistently low after treatment, Protective Life may offer coverage without any extra premium surcharges.

Gerber Life Insurance Company

Gerber Life Insurance offers guaranteed acceptance whole life insurance, which can be an ideal option for individuals currently undergoing or recently completing treatment for prostate cancer. This type of policy does not require a medical exam or health questions. However, the level of coverage will be reduced for the first two years.

It is important to note that the availability of coverage and specific policy terms may vary depending on a man’s unique circumstances and the insurance company’s underwriting guidelines. Consulting with an experienced life insurance agent can help identify the best insurance companies for prostate cancer survivors.

How to Apply for Life Insurance After Prostate Cancer

Applying for post-prostate cancer life insurance requires careful preparation and consideration. Here are some steps to follow when seeking coverage:

Gather Necessary Documentation

Collect all relevant medical records, pathology reports, and documentation related to your prostate cancer diagnosis, treatment, and follow-up care. The more information you can supply to the life insurance underwriter, the easier it will be for the insurer to make a decision on availability and cost.

Research Insurance Companies

Research insurance companies known for their favorable underwriting guidelines for prostate cancer survivors. Consider their financial stability, customer reviews, and policies tailored to individuals with a history of cancer.

Consult with a Knowledgeable Agent

Seek guidance from a knowledgeable life insurance agent who specializes in helping individuals with pre-existing medical conditions, such as prostate cancer. They can guide you through the application process, provide insights on different insurance companies, and help you find the best policy for your needs.

Complete the Application

Fill out the life insurance application accurately and thoroughly. Provide detailed information about your prostate cancer diagnosis, treatment, and current health status. Be prepared to answer questions about your PSA levels, Gleason score, and any other relevant medical details.

One At A Time

This one piece of information may determine if you qualify for life insurance or not. There are two ways to approach the application process. Your insurance agent may ask you to complete a preliminary inquiry first. This allows the agent to submit your information to multiple insurance companies without your name. The insures will indicate the probability of you getting an offer from their company. The preliminary inquiry may have some limitations and not be available for every man, but it is the best approach if available.

The second approach should be applying for one insurance company at a time. Every life insurance application requires that you agree to share your basic information with the Medical Information Bureau (MIB). So, if you apply for more than one life insurance, the companies will not work against each other. There is a high probability that you will be declined coverage from all life insurance companies. So, apply one at a time, and if you have not accepted an offer or been declined coverage, be sure to disclose that information. If the insurer perceives you are not being forthright, they will decline your coverage.

Undergo Medical Exams if Required

Some insurance companies may require medical exams as part of the underwriting process. Be prepared to undergo a physical examination, blood tests, and other tests if requested.

Review Policy Options

Once you receive quotes and policy offers from insurance companies, carefully review the coverage options, premium rates, and policy terms. Consider consulting with your agent to ensure you fully understand the details and make an informed decision.

Accept or Decline Offers

After comparing different policies, you can accept an offer that meets your needs or decline if none of the options align with your requirements. Keep in mind that it is always possible to reapply or explore different insurance companies if needed.

Conclusion

Securing post-prostate cancer life insurance is indeed possible. With advancements in medical treatments and evolving underwriting guidelines, insurance companies are more accommodating to men with a history of prostate cancer. By understanding the factors that influence underwriting decisions, researching reputable insurance companies, and working with experienced agents, prostate cancer survivors can find suitable coverage that provides financial protection and peace of mind for themselves and their loved ones.

Remember, each man’s situation is unique, and the availability of coverage and specific policy terms may vary. Consulting with a knowledgeable agent is essential to finding the best life insurance options after prostate cancer. Don’t let a prostate cancer diagnosis deter you from seeking the protection you and your family deserve.

To see which coverage would be best for you, complete the request for a quote by clicking the button below. However, understand that the quote you will be supplied will be without consideration of prostate cancer. We will review each request for information individually and contact you to gather more details.