John Hancock Life Insurance Review

Overview–

The primary focus of this review centers on term life insurance available through John Hancock Life Insurance. We are focusing on the product and the company because some companies are better at term or cash value life insurance. John Hancock is one of the top providers of term life insurance. As an illustration, we’ll discuss the top considerations to look for when shopping for term life insurance. Then I’ll show how those considerations apply to John Hancock Life Insurance. Let’s begin by looking at the highlights of term life insurance from John Hancock.

Highlights–

Advice4LifeInsurance.com Ranking: John Hancock Life Insurance is a top choice for anyone looking for term life insurance. Depending upon your circumstances, there may be better options. However, John Hancock Life Insurance is such a financially strong and competitive option that it should be a prime consideration, especially when shopping for term life insurance.

Top Considerations for Any Term Life Insurance–

- excellent customer service

- relatively low premiums

- consistent underwriting standards

- financially stable

Special Programs from John Hancock Life Insurance-

- Vitality Rewards– incentivizes policy owners to focus on extending their lifespan by remaining physically active.

- Quit Smoking Incentive – smokers that qualify for life insurance may request a rate reconsideration after twelve months of being nicotine free.

- Aspire with Vitality – Life Insurance for people with diabetes

Next, let’s look at the recent financial ratings from five well-established rating services and a Comdex Ranking.

John Hancock Life Insurance Financial Ratings

Company ratings indicate the likelihood that a life insurance company can maintain its business and pay future benefits. With this in mind, financial and safety ratings should be paramount when buying life insurance. For example, if you are buying term life insurance, you surely want to know that the company will be able to pay your beneficiaries if you die.

Most of the rating services describe John Hancock Life Insurance as “superior,” “very strong,” “good financial security,” and very strong. But Moody’s says, “elements may be present which suggest a susceptibility to impairment sometime in the future.” And Weiss states John Hancock’s financial stability as “fair.” However, Weiss further says they “feel it (John Hancock) may encounter difficulties in maintaining its financial stability” during an economic downturn.

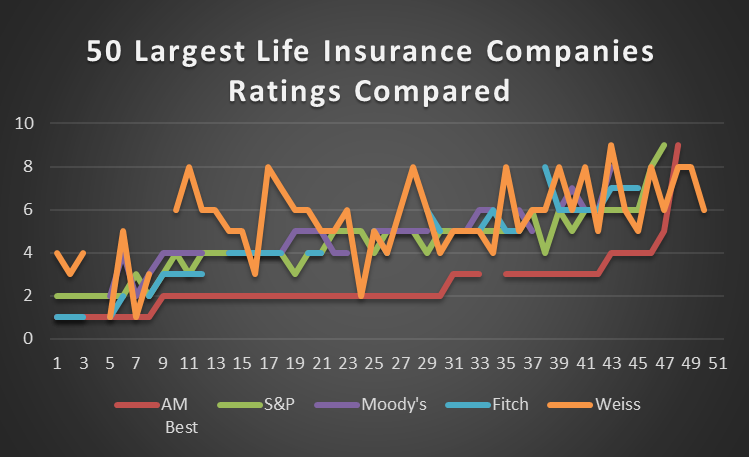

So what does all this mean regarding buying a term life insurance policy? In other words, why do some companies paint a rosy picture and some companies pessimistic? That all depends on you. But first, I would like to remind you that any rating is not infallible. Here is my perspective. Let’s look at the pattern of life insurance companies’ ratings. I charted the ratings from the 50 largest life insurance companies.

How Ratings Compare

All insurance companies have the same universe of investments from which to pick. Yes, each company manages its assets and business differently. But based on the fact that they only have a finite universe of options, how they arrive at the conclusions of their analysis should not be that much different. To illustrate my point, here is the result of my analysis.

I started this analysis because there is one rating company that is an outlier. That company is Weiss Rating. So I thought, how can the other four major rating services rate a company high and Weiss rate it low? After studying the ratings, I have two insights. First, some outliers or insurance companies have a low rating from Weiss and a high rating from the other rating services. But not that many. Second, Weiss’ ratings are not that much different. You’ll see what I mean in a moment. Be that as it may, Weiss has taken a different approach.

Rewriting the Alphabet

In truth, all the rating services have changed over the years. We’re all familiar with the A through F grading system. In general, A is excellent, and F is bad. Then the plus symbol was added. All of a sudden, an A+ was superb! Which is better than excellent. Then again, the rating companies took the symbols one step further. You can now have a company rated as an A++! Look at what has happened. In reality, over the years, rating services have stretched the distance between the first three letters of the alphabet from three letters to twenty-one spaces. To that end, Moody’s and Fitch Ratings ratings start with triple A and go to single C. There are twenty-one variations of those three letters in between. Most people are surprised to see how insurance company rankings have been marketed over the years.

Lowering the Bar

We see that Weiss lowered the bar for rankings. But then again, some rating companies appear to be throwing softballs. Currently, of the 50 largest life insurance companies, AM Best awards 44 of them either A++, A+, A, or A-. On the other hand, out of those same 50 companies, Weiss awards 36 of them B+, B, or B-. In essence, Weiss graded the same companies on a lower curve.

To that end, here again, are the ratings for John Hancock.

- A.M. Best Company (Best’s Rating, 15 ratings) A+ (2)

- Standard & Poors (Financial Strength, 20 ratings) AA- (4)

- Moody’s (Financial Strength, 21 ratings) A1 (5)

- Fitch Ratings (Financial Strength, 21 ratings) AA- (4)

- Weiss (Safety Rating, 16 ratings) C+ (7)

In any case, it is up to you, the consumer, to interpret the rankings as you see fit from my professional point of view. The fact that John Hancock has a C+ from Weiss does not bother me. All in all, John Hancock is a financially strong company and should have no problem paying its claims. After all, isn’t that the most critical part of owning a term life insurance company? That is, the insurance company should have no problem paying your beneficiary the death benefit of your life insurance policy if you die.

The Bottom Line

Suppose you are applying for a term life insurance policy. In that case, you should have three essential things:

- the policy’s price

- an easy-to-understand and timely underwriting process

- the probability of getting what you requested and bought.

In the final analysis, here are the answers related to those factors.

- John Hanock has some of the lowest rates compared to other well-rated life insurance companies.

- About one-third of those who apply for a policy do not require blood or urine test. The company, via the agent, keeps you up-to-date on the status of your application.

- This is the most important part of applying for a life insurance policy for all the clients I have worked with over the years. That is, getting what you were sold. In other words, the policy is issued at the quoted price. Of course, there are circumstances where the cost may change, usually for health reasons.

Here is what most clients experience. All things considered, around 70% to 80% of the policies that the company offers are at the cost they were initially quoted. Finally, finalizing a life insurance policy takes a week to five weeks. If your application is straightforward without medical testing, it is about a week. If there are more extensive requirements, expect about five weeks before getting your policy. Most of the time, younger ages get policies faster than older ages. Older ages usually require more time to obtain medical information. But John Hancock is outstanding at keeping the agent informed weekly on the progress of an insurance application. In turn, your agent should be in contact with you weekly to let you know the progress of your application.

John Hancock Life Insurance Has a Long History of Excellent Service

John Hancock Life Insurance Company has a storied past. The company was established in 1862 and took its name to signify a sign of stability and strength. The namesake, John Hancock, was the first signer of the Declaration of Independence and served as the President of the Continental Congress for two years.

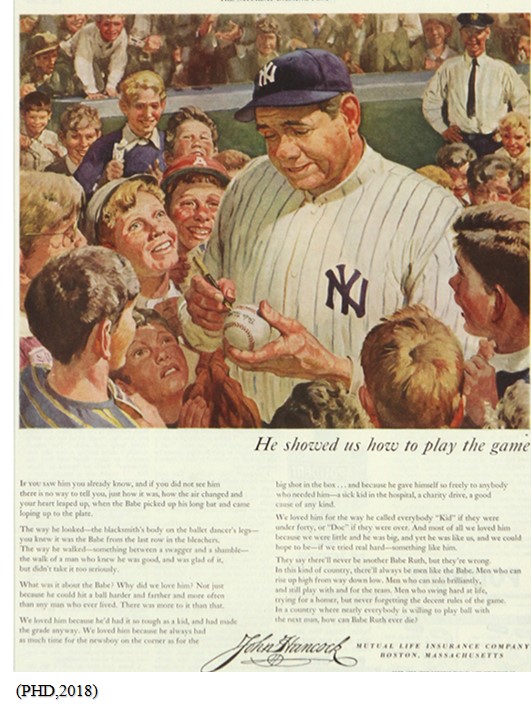

Through the 1950s and 1960s, John Hancock Life insurance advertised its life insurance services by associating with recognizable sports figures and artists. They ran ads in publications such as Life magazine and the Saturday Evening Post. Below is an advertisement featuring baseball players Babe Ruth.

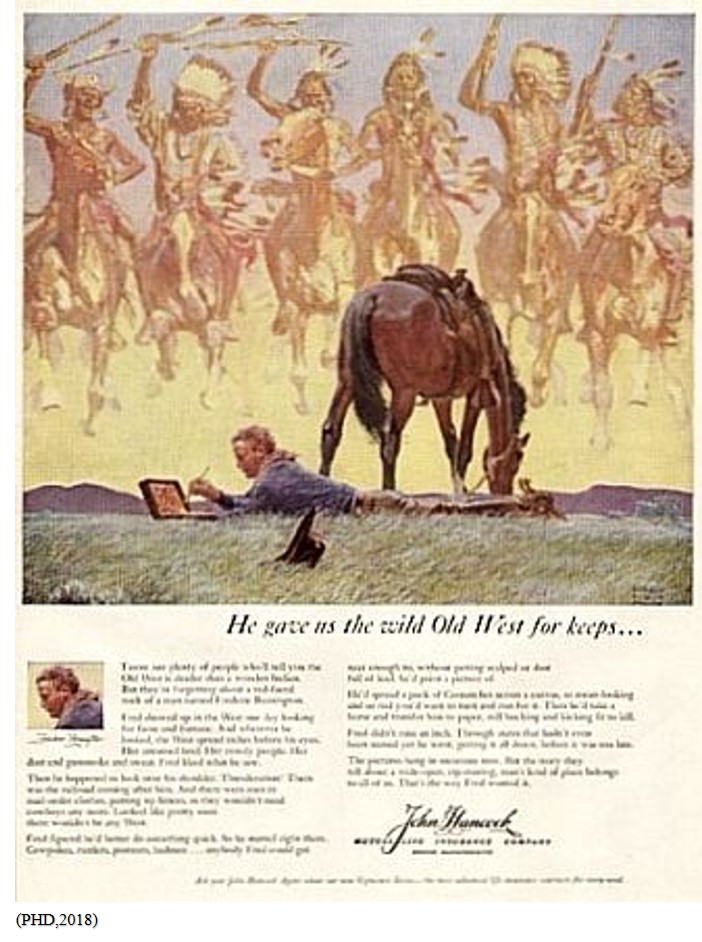

John Hancock later used the works of artist Fredric Remington to advertise the life insurance company.

The company no longer uses athletes or artists to promote its life insurance company. However, they still do use the famous image of John Hancock’s signature as a company logo.1

John Hancock Life Insurance Trends Toward the Future

John Hancock’s Vitality Life Insurance program is an innovative approach to helping people protect their families with life insurance. Vitality is a new type of life insurance called interactive life insurance. The strategy is to tie a person’s ongoing health to life insurance with monetary incentives. Each customer gets a smartwatch at a significant discount in this program.

Consequently, the insured is encouraged to use the smartwatch. The data collected on the smartwatch is communicated to John Hancock. Then, if an insured maintains a certain level of physical activity, they earn monetary incentives.

John Hancock Life Insurance is the first major life insurance company to switch its entire business model to interactive life insurance. “Interactive life insurance is designed to help policy owners live longer lives. Interactive life insurance is like a secret that the rest of the world already knew about, and it was finally introduced to the United States. It is very competitively priced and is more actuarially sound than life insurance sold based on big data.” 2

In Summary

So if you had life insurance from a company that gave you good service, a competitively low price policy, what you asked for, and were financially stable, would you be happy? Of course, you would. Those are the reasons that John Hancock is my number one pick for clients shopping for term life insurance. If you’d like to see if John Hancock is the right company for you, click here. Complete the Compare Quotes section and click Get Started.

References

1 “John Hancock | Search Results.” The Pop History Dig | The Pop History Dig is a Website Offering Historical and Topical Stories on Business, Politics, and Popular Culture. Accessed September 10, 2019. https://www.pophistorydig.com/?s=John+Hancock

2 Richards, V. (2018, December 2). Live Longer With Interactive Life Insurance!